How Urbanization is Escalating Demands for Urban Infrastructure Funding and How Cities and Investors are Responding

mai 27, 2016 — Uncategorized

Around the world, the migration of populations into cities in both advanced and developing economies is exerting pressure on the urban infrastructures of cities and on the governments that manage them. Governments face the challenges of shoring up physical facilities and systems—as well as preparing for the digital revolution—often with the added pressure of tighter budgets and static levels of private sector investment. According to the International Finance Corporation, over the past 10 years, these factors have led to a critical shortfall in financing, one that the World Economic Forum had already assessed at ~$1 Trillion in 2014. If cities are to address the gap between needs and resources, both public- and private-sector institutions must collaborate to develop creative solutions to allow cities to effectively deliver citizen services.

No doubt you’ve heard about The Internet of Things…well when you add to things connections with data, people and processes, you are looking at a formidable digital transformation. This transformation is already beginning to allow cities to address their challenges in new (and integrated) ways, drawing on solutions that can deliver a wide range of benefits for cities and for citizens. This can include optimized parking, reduced traffic, greater public safety, more efficient waste management. By digitizing city systems—or making them smart—cities facing urbanization pressures can leverage techniques that will allow them to manage infrastructure and deliver services more efficiently, while also enabling new business models to support this critical transformation. Solutions can tap sensors, video cameras, people’s mobile devices, and other sources to share data in real-time across many organizations and government agencies to enhance the knowledge base of a city and speed decision making and response times.

Let’s look at two examples: Parking and Street Lighting

If you’ve ever looked for parking in a big city, you know it can be a nightmare. And slow parking often leads to choked traffic as drivers crawl around the block looking for a space. Did you know that parking is the second largest revenue generator for cities after taxes? So it’s important for cities (and drivers) to take full advantage of the available spaces and manage how they’re used to capture the enormous revenue opportunity. Parking solutions, both video and sensor-based, can now provide real-time notification to citizens on open parking spots, alert parking enforcement when a violation has occurred and deliver analytics to parking operators and city managers. These solutions enable new revenue capture through improved enforcement, dynamic pricing and selling analytics data to merchants and parking operators. They also trim costs by optimizing parking enforcement and reducing labor costs.

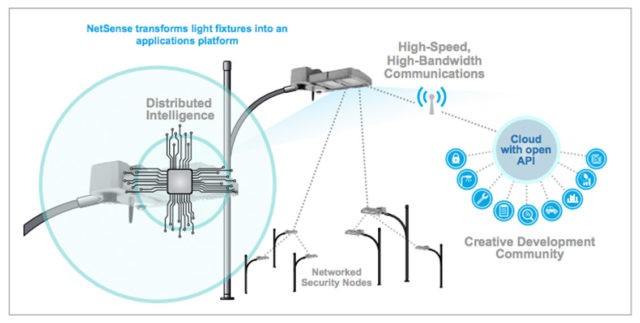

Street lighting can account for as much as 30% of the energy bill for a city. Traditional street lighting in cities is inefficient and expensive to maintain. Many cities are already upgrading to light-emitting diode (LED) fixtures for energy efficiency and longevity. To fully leverage this migration, many are also considering a new generation of sensor-enabled lights. When these powered sensor hubs are mounted on light poles, they can not only assess and report on the condition of the fixture itself and on the ambient lighting conditions–to allow dynamically modulation of lighting levels–but, they can also capture a panoply of environmental data including moisture, pollutants, seismic activity, CO2 levels and more. They can also analyze video data from the integrated camera for security functions such as facial and license plate recognition. Sensity, a Cisco partner, offers a network platform solution that combines smart lighting with these features for traffic, parking and other critical urban services applications. For these reasons, smart lighting is an attractive investment for private investors; they view it as a real asset with high barriers to entry, clear payback from energy savings and an upside from new data monetization models.

When it comes to investing, Cisco is also developing its own innovative infrastructure funding model. The Cisco Global Infrastructure Fund provides equity and mid-level (“mezzanine”) capital into large-scale technology infrastructure projects alongside institutional investors. This allows Cisco to invest directly into smart city projects that meet defined financial criteria.

Cisco is also leveraging its relationship with Whitehelm Capital, one of the world’s largest independent infrastructure managers to fund city projects that would otherwise be difficult or impossible. Whitehelm has a 17-year track record, a current portfolio of 40 infrastructure assets, approximately US$3.5 billion in funds under its management and more than US$10 billion in funds under advice. Whitehelm and Cisco are collaborating to create a “concession model.” A concession model is an arrangement where a private entity contracts with a government agency to design, build and operate a private facility or offer services for the exclusive benefit of the government agency in return for a fixed monthly fee from that government agency, which then sets pricing, taxes and tolls in the city. This arrangement is already being used to scale lighting, parking, traffic and other priority urban services in a number of cities.

For examples of how the urban investment gap can be bridged, I harken back to a panel I moderated at the 2015 New Cities Summit in Jakarta. The researchers, public sector leaders, and financiers on the panel explored how innovative investment models can serve both the public and private sectors. One of the panelists, Julie Kim, senior fellow at NewCities, observed that often the problem is not a lack of funding, but rather a lack of “bankable projects.” Cities can work more effectively with investors by presenting their smart cities projects in an attractive package built on a strong, reliable foundation, including clear policies, low regulations and credibility in international insurance markets.

“The most critical gap is in the early project preparation stage,” noted Kim, “where cities take their visions and translate them into actual projects for investors. She added that more support is required from NGOs and other institutions at this stage.

Najeeb Haider of Citi agreed, noting that it is vital that infrastructure schemes have legal structures that are planned in advance and that cities have clarity over what is expected in contracts. He also outlined that the key priority for structuring infrastructure financing is the allocation of risks. Governments can help “de-risk” these projects by contributing some of the initial project financing and simplifying project governance via smart regulation.

We are in the early innings of developing scalable financial models for smart city projects. However, the time seems right for us as an industry to address these challenges. There are fewer doubts as to whether the technology will work. Cities are ready to undertake—and some already have—large-scale deployments. There is an appetite amongst private investors for financing smart city projects. Perhaps in only a couple of years we will see financing for smart lighting and smart parking discussed as directly or even in conjunction with financing for traditional infrastructure projects like toll roads or bridges.

For more information on Cisco’s offerings in Smart Cities please refer to the following link www.cisco.com/go/smartconnectedcommunities